Table Of Content

[1] Using this method, a home with a market value of $400,000 would have a home insurance premium of more or less $1,400. Find the insurance you need and save by shopping from the most trusted insurers. The same goes for Florida, where as many as 10 companies have already gone insolvent since 2020. [3] Last year, AAA announced it would not renew home insurance policies in "higher-exposure" areas of Florida, and Farmers announced it will stop writing new policies and won't renew thousands of existing ones. [4] This is on top of Progressive, AIG, and Heritage who had already announced they were no longer writing new policies in Florida.

The Average Cost of Homeowners Insurance in April 2024 - MarketWatch

The Average Cost of Homeowners Insurance in April 2024.

Posted: Mon, 22 Apr 2024 07:00:00 GMT [source]

How long does it take to replace a roof?

As such, experts recommend choosing a company that has a strong financial history, high rates of customer satisfaction and robust coverage offerings. Some ZIP codes, including neighboring ones, are often exposed to different risks or could have significantly higher or lower home values compared to your ZIP code. Because a home's location risk and size are two of the main drivers of insurance rates, average home insurance prices can fluctuate drastically from area to area. Nebraska and Kansas are the most expensive states for homeowners insurance, likely because they are in Tornado Alley.

Get quotes from a home insurance marketplace

A new roof costs $300 to $600 per square (100 SF) on average, including materials and installation. Since last year, nearly three-quarters of the state’s insurance companies have reduced their exposure in the market due to record wildfire-related losses, including last year’s Marshall Fire. [9] [10] This has made it more difficult for homeowners to find coverage altogether, let alone affordable premiums. Mercury only writes home insurance policies in 10 states, California being one of them, and may appeal to homeowners who prefer a smaller company. Its difference in conditions, in particular, may appeal to homeowners who have had to resort to the California FAIR plan, an insurance program for homeowners unable to secure coverage in the private market. The difference in conditions endorsement can help fill in coverage gaps found in the FAIR plan, such as rain, theft, water service line and liability coverage.

What does home insurance cover?

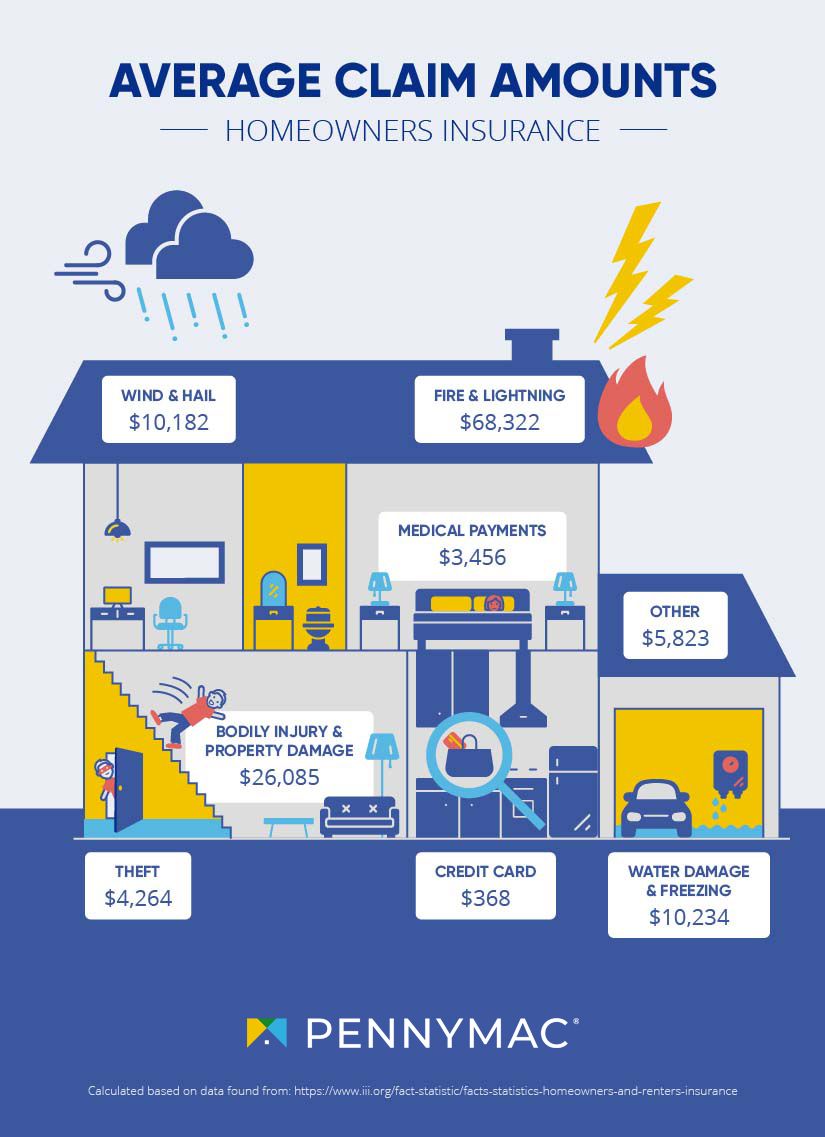

Medical payments coverage typically has a low limit, between $1,000 and $5,000. Kara McGinley is deputy editor of insurance at USA TODAY Blueprint and a licensed home insurance expert. Previously, she was a senior editor at Policygenius, where she specialized in homeowners and renters insurance. Her work and insights have been featured in MSN, Lifehacker, Kiplinger, PropertyCasualty360 and more. These are sample rates and should be used for comparative purposes only. California, Hawaii, Maryland and Massachusetts do not allow the use of credit scores for insurance rating purposes.

Homeowners insurance costs increased by nearly 11% between 2021 and 2022 according to private banking firm S&P Global, joining the list of necessary services hit by inflation. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

Cheapest home insurance companies in California

This pays to repair or replace (rebuild) your house and attached structures, like a garage or deck. The dwelling insurance limit should cover the cost of rebuilding your house. While your house and belongings are two of the main items protected by homeowners coverage, there is much more to what a home insurance policy covers.

This is likely because homes in El Paso and other areas in West Texas don't face the same type of risks as those on the eastern half of the state. Hawaii’s low home insurance rates are partly because home insurance policies exclude hurricane damage. However, banks require a supplemental hurricane insurance policy to approve a mortgage in Hawaii; this total cost should be considered when pricing home insurance here.

Like Allstate, State Farm also boasts an impressive, nationwide network of agents. Additionally, State Farm’s average premium for homeowners insurance is on par with the national average. Also known as AmFam, American Family’s average annual premiums are considerably lower than the national average.

Berkshire Hathaway to pay $250 million to settle real estate commission lawsuits

Blueprint does not include all companies, products or offers that may be available to you within the market. The home insurance market has faced several challenges in recent years and with 2024 well underway, we are better able to see the ripple effects. Insurance is reactionary — it takes some time for insurance companies to recoup losses (in the form of increased premiums) caused by inflation, widescale extreme weather-related disasters and other complex challenges. If you are unsure what your policy covers, talk to your agent or insurance company for clarification.

The 2023 Policygenius Home Insurance Pricing Report is based on internal policyholder data from 17,401 policy renewals from May 2022 to May 2023. One-third of those who lost coverage moved or plan to move as a result of that, they told RedFin. Insurance Commissioner Ricardo Lara says the proposed reforms, which would not need legislative approval or to be signed by the governor, represent the biggest changes to the state’s insurance market since 1988.

Higher dwelling coverage amounts raise homeowners insurance rates because the insurance company must be prepared to pay out a larger sum in case of a loss. Keep in mind, your dwelling amount is the cost to rebuild your home, not your home's market value. Your dwelling amount depends on your home's materials, its size and local labor costs.

One of the best and easiest ways to find the cheapest home insurance is by comparing quotes from multiple companies. Check rates from at least three so that you can start to see the range of potential costs. Home insurance plays an essential role if you’re a homeowner, but home insurance costs can stretch well over $1,000 annually, depending on the policy and where you live. Contractors install the new roof material on top of the existing roof, which saves money but may decrease the roof’s lifespan. A tile roof costs $7 to $25 per square foot or $10,500 to $62,500 installed on average. Concrete tile is the most budget-friendly option but may require sealing.

Meanwhile, San Jose, California, was the cheapest city on the list, with an average annual rate of $1,055. Home insurance costs have gone up due to inflation, supply chain concerns and extreme weather. Inflation and supply-chain issues are leading to more expensive construction costs, home insurance claims and, as a result, home insurance rates.

The primary bill (SB 7028) signed by DeSantis provides $200 million for the grant program, with new parameters for how the funding is to be distributed. The other bill (HB 1029) allows condominium associations to be eligible for inspections and grants. To request more information about the data, or to speak with one of our experts, contact With home insurance price increases expected to continue for the rest of 2023 and beyond, there are a number of factors contributing to this new normal. While this may seem like good news for homeowners, it is actually one of the many factors that contributed to the market instability plaguing the state.

The table above can help you get a sense of the average cost of home insurance across the country so you know what to expect when purchasing homeowners insurance. Always compare home insurance quotes from at least three companies at least once a year. The best company for you today might not be the best later if your circumstances change, like if you file a claim or remodel your home.

No comments:

Post a Comment